Salinas Lithium Project,

Brazil

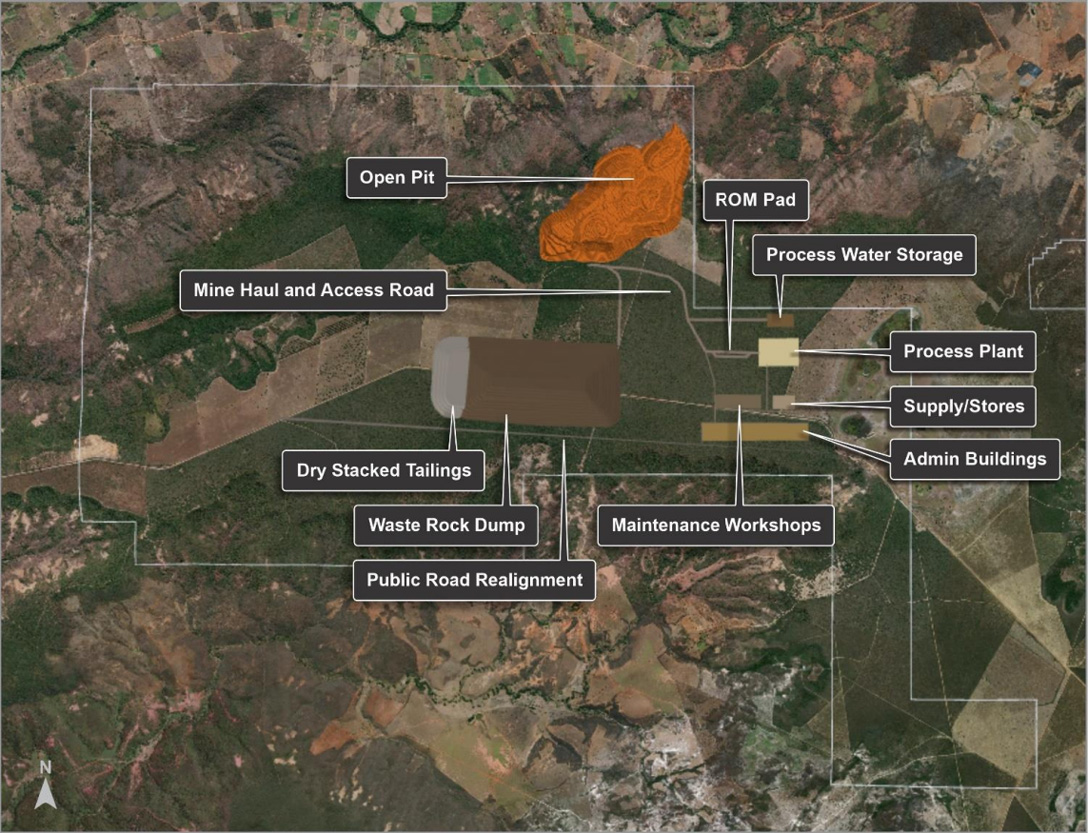

- Developing a proposed 3.6Mtpa standalone fully sustainable mining and processing operation

- Potential to establish the Company as the second largest spodumene concentrate producer in Brazil and among the lowest cost spodumene concentrate producers globally.

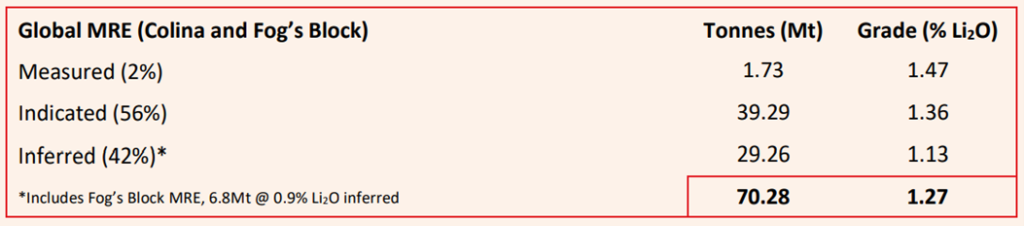

- Salinas Lithium Project Mineral Resource Estimate of 70.3Mt @ 1.27% of Li2O at the Colina and Fog’s Block Deposits.

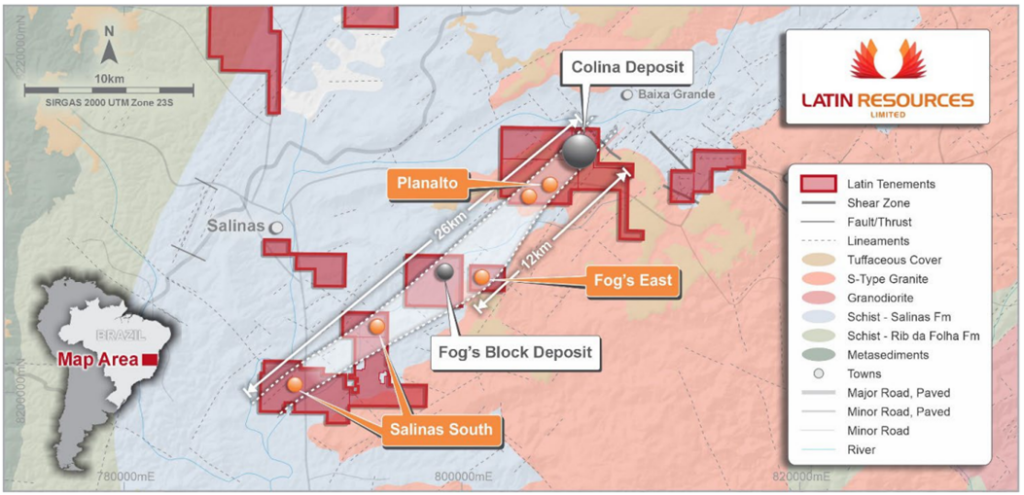

- Significant expansion potential with tenements covering over 38,000 hectares in the Minas Gerais region of Brazil.

Location

Latin has invested significant time and geological resources investigating the lithium potential of Bananal Valley region of Minas Gerais, which hosts the Eastern Brazilian pegmatite province.

The Salinas Lithium Project is located 10km outside the town of Salinas (population 40,000), accessible by major sealed roads. The Project is located in the Bananal Valley, north-east of Minas Gerais, 600km north-east of Belo Horizonte.

Latin’s neighbour, regional success story Sigma Lithium, has been producing environmentally sustainable battery-grade lithium concentrate on a pilot scale since 2018. Sigma went into production in mid-2023 at its Grota do Cirilo project, with annual production of 766 Kt/y Green Lithium | 104 Kt LCE.

The state of Minas Gerais is well serviced by infrastructure, roads, hydroelectric power, water and the port of Vitoria in the neighbouring Espirito Santo State. The province is particularly efficient in its issuing of drilling permits and environmental approvals.

Latin has experienced significant support from the local community and government at Minas Gerais, with the “Lithium Valley” initiative to support the battery materials sector and supply chain investment in the region. Further support has been shown through placement funds from North American and Brazilian institutions, with Salinas Lithium Project now being fully funded through to development licence approval applications.

Preliminary Economic Assessment (PEA)

The Salinas Project PEA was led by independent consultants SGS, based on the previous Salinas mineral resource estimate of 45.2Mt at 1.32% Li2O (including 0.43Mt @ 1.34% Li2O Measured + 29.7Mt @ 1.37% Li2O Indicated + 15.0Mt @ 1.22% Li2O Inferred) for a proposed 3.6Mtpa standalone mining and processing operation, demonstrating strong financial metrics for the Salinas Project.

The PEA incorporates Phase 1 and a Phase 2 processing plant, and demonstrates robust combined economics, highlighted by a combined after-tax NPV8% of A$3.6 billion (US$2.5 billion) and combined after-tax IRR of 132%.

The PEA confirms that the Company will be a large-scale, low-cost producer of a fully integrated concentrate plant and environmentally sustainable production of SC5.5 and SC3 spodumene concentrate, with significant cost saving benefits and competitive market advantages from its geographical location.

The PEA contemplates an initial mine life of 11 years generating significant net cash flows over the Life of Mine (LOM) with a capital payback achieved in the first 7 months of the Salinas Project life under Phase 1. Financials are based on a weighted average spodumene concentrate price of US$1,699t/CIF SC5.5 and US$927t/CIF SC3, using an average of price forecasts from Fast Markets and Benchmark Minerals; the two leading price reporting agencies in the lithium sector.

Key factors influencing the robust PEA economics include:

- High average feed grades of 1.24% Li2O across both Phase 1 and Phase 2;

- Excellent average recovery rates achieved by Dense Media Separation (DMS) circuit of 78.3% comprised of 67.2% for SC5.5 and 11.1% for SC3; and

- Phase 1 production commencing in 2026 with Phase 2 average production of 525,000 tpa SC5.5 and 159,000 tpa SC3 commencing 2029.

The results of the PEA and recent MRE expansion will serve as the foundation for the DFS which is expected to be completed mid-2024.

Key Physical Assumptions for the Salinas Project

| Assumption | Unit | Total |

| Mining and Production | ||

| Life Of Mine | Years | 11 |

| Plant Nameplate Capacity ROM | Mtpa | 3.6 |

| LOM Average head Li2O Grade | % | 1.241 |

| Total quantity mined | Mt ore | 31.4 |

| Stripping ratio | x | 17.6 |

| Total Production (SC5.5) | Mt | 4.45 |

| Annual Production (SC5.5) | ktpa | 405 |

| Total Production (SC3) | Mt | 1.35 |

| Annual Production (SC3) | ktpa | 123 |

| Process Plant Recovery (SC5.5) | % | 67.2 |

| Process Plan Recovery (SC3) | % | 11.1 |

- Weighted average fully diluted grade over LOM

Summary of outputs and assumptions for the Salinas Project

| Item | Unit | Total |

| Economic Analysis | ||

| Post-Tax NPV8 | A$B | 3.6 |

| Post-Tax IRR | % | 132 |

| Payback Period | Months | 7 |

| Concentrate price (CIF) SC5.5 (weighted average) | US$/t SC5.5 real | 1,699 |

| Concentrate price (CIF) SC3 (weighted average) | US$/t SC3 real | 927 |

| Exchange rate | AUD:USD | 0.70 |

| Corporate tax rate (incorporating the Sudene tax incentive) | % | 15.25 |

| Revenues, Cash Flow and Capex | ||

| Average annual revenue | US$m | 802 |

| Average annual after-tax free cash flow | US$m | 383 |

| Phase 1 capital expenditure (initial capital including pre-strip) | US$m | 253 |

| Phase 2 capital expenditure (deferred capital) (excluding closure) | US$m | 55 |

| Costs per tonne of spodumene | ||

| Total cash costs (AISC, CIF, including royalties) | US$/t | 536 |

| Phase 1 and 2 global lithium recovery rate, comprised of: | % | 78.3 |

| SC5.5 spodumene recovery | % | 67.2 |

| SC3.0 spodumene recovery | % | 11.1 |

| Integrated costs per tonne of spodumene concentrate | ||

| Mining costs | US$/t | 328 |

| Plant processing costs | US$/t | 36 |

| G&A costs | US$/t | 15 |

| Royalties | US$/t | 31 |

| Transportation costs (mine to CIF China) (dry metric tonne (“DMT”)) | US$/t | 126 |

| Integrated costs as modelled | ||

| Mining costs | US$/t material | 3.42 |

| Plant processing costs (2026 and 2027) | US$/t ore | 7.13 |

| Plant processing costs (2028+) | US$/t ore | 4.62 |

| Tailings costs | US$/t tailings | 2.18 |

| G&A costs | US$/t ore | 2.70 |

| Royalties | % revenue | 2.0 |

| Transportation costs (mine to CIF China) (wet metric tonne (“WMT”) | US$/t spod | 120 |

Mineral Resource

The Salinas Lithium Project Global Mineral Resource Estimate provides for 70.3Mt @ 1.27% of Li2O at the Colina and Fog’s Block Deposits.

Colina Lithium Deposit Mineral Resource Estimate:

The Colina Lithium Deposit MRE stands at 63.5Mt @ 1.3 Li2O, reported above a cut-off of 0.5% Li2O. This resource represents a Lithium Carbonate Equivalent (LCE) of 1.5Mt.

The classification of this JORC MRE includes 1.7Mt @ 1.5% Li2O Measured + 39.3Mt @ 1.4% Li2O Indicated + approximately 22.5Mt @ 1.2% Li2O Inferred.

The Company’s MRE represents a 41% increase from the previous estimate of 45.2Mt @ 1.32% Li2O. A program of close spaced infill drilling at Colina resulted in a significant uplift of grade in both Measured and Indicated JORC resource categories.

Fog’s Block Lithium Deposit Mineral Resource Estimate:

Fog’s Block is located approximately 12km southwest of the Company’s Colina Lithium Deposit, and Latin has defined a maiden inferred mineral resource of 6.8Mt @ 0.87% Li2O Inferred at a cut-off grade of 0.5% Li2O.

Fog’s Block remains open up-dip, at depth and along strike. Drilling continues to test for extensions to the defined deposit and build on the maiden resource.

The substantial increase in the Global MRE for the Project will have a significant positive effect on the economics within the DFS, due for completion in mid-2024. The initial PEA mining plan allowed for a Phase 1 production commencing in 2026 with Phase 2 average production of 525,000 tpa SC5.5 and 159,000 tpa SC3 commencing 2029. The increase of MRE will now include a phase 3 extension and expansion to production which will be evaluated in the DFS.

Salinas Mineral Resource Estimate reported at 0.5% Li2O cut-off grade separated by category

| Deposit | Resource Category | Tonnes (Mt) | Grade (Li2O %) | Li2O (Kt) | Contained LCE (Kt) |

| Colina | Measured | 1.73 | 1.47 | 25.8 | 62.8 |

| Indicated | 39.29 | 1.36 | 534 | 1,320.6 | |

| Measured + Indicated | 41.02 | 1.36 | 559.4 | 1,383.4 | |

| Inferred | 22.47 | 1.2 | 271.8 | 672.1 | |

| Total | 63.49 | 1.31 | 831.2 | 2,055.6 |

Fog’s Block Mineral Resource Estimate reported at 0.5% Li2O cut-off grade separated by category

| Deposit | Resource Category | Tonnes (Mt) | Grade (Li2O %) | Li2O (Kt) | Contained LCE (Kt) |

| Fog's Block | Measured | - | - | - | - |

| Indicated | - | - | - | - | |

| Measured + Indicated | - | - | - | - | |

| Inferred | 6.79 | 0.87 | 57.3 | 141.7 | |

| Total | 6.79 | 0.87 | 57.3 | 141.7 |

Metallurgy

The Company engaged SGS Lakefield laboratories, Canada to conduct a bulk metallurgical test work program on ore from the Company’s Colina Deposit. Results were independently reviewed and interpreted by MinSol Engineering Pty Ltd, whose key personnel have significant experience in lithium processing, metallurgy, and process plant design.

The purpose of this program was to assess the efficiency of DMS, a conventional and industry standard process that beneficiates spodumene from gangue minerals under a gravity-based separation technique. To compliment this, Heavy Liquid Separation (HLS) test work was also carried out in parallel on the composite samples to assess the larger scale DMS process performance.

The first bulk DMS tests produced a high-quality concentrate grading 5.5% Li2O at 93.1% stage2 recovery from a representative sample with a head grade of 1.38% Li2O.

Due to the scale of the test, the results are considered a reliable indication of commercial DMS performance, and stage recoveries of greater than 90% to a 5.5% Li2O sinks concentrate are anticipated. Additionally, while simpler and more cost effective to produce, a coarse DMS product is more favourable for conversion into Lithium Chemicals (Lithium Hydroxide) due to its reduced fines content and as such will be attractive to end users.

References

- ASX Announcement 20 June 2023 – 241% Increase for the Colina Mineral Resource

- ASX Announcement 28 September 2023 – Robust results for Colina Lithium Project PEA

- ASX Announcement 10 August 2023 – Positive DMS Test Work – Salinas Lithium Project

- ASX Announcement 6 December 2023 – Significant increase to JORC Resource at Salinas